Inherited Roth Ira Rules 2025

Inherited Roth Ira Rules 2025. With previous irs relief, penalties are waived for missed rmds from. Reported by paul mulholland the internal revenue service has again.

Key points roth individual retirement accounts don’t have required minimum distributions during the original owner’s lifetime. But depending on your relation to the deceased and other factors, different rules.

One Exception Is That If You’re The Spouse Of The Original.

As mentioned before, for assets in an inherited ira, the surviving spouse must take.

So If You Make $65,000 A Year, Withdrawing $35,000 From An Inherited.

What are the current distribution rules and tax impacts for inherited traditional and roth iras?

Inherited Roth Ira Rules 2025 Images References :

Source: www.goodreads.com

Source: www.goodreads.com

INHERITED IRA RULES How to Minimize Inheritance Taxes with Stretch, If you inherit a roth ira, you generally must withdraw the funds within 10 years. Inherited ira rmd calculator 2025.

Source: www.core-wm.com

Source: www.core-wm.com

Rules for Inherited Roth IRAs Fee Only, Fiduciary, Financial Planning, One exception is that if you’re the spouse of the original. You can inherit a roth individual retirement account (ira) and avoid a lengthy court process known as probate as long as the person who passed away listed you as a.

Source: www.aaii.com

Source: www.aaii.com

Inherited IRA Rules Before and After the SECURE Act AAII, Unlike transferred iras, inherited ira rules require you to take annual distributions no matter your age. The irs is delaying certain required minimum distribution (rmd) rules.

Source: www.youtube.com

Source: www.youtube.com

Inherited Roth IRA Rules for Surviving Spouses and Children YouTube, When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply. While you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions.

Source: carmichael-hill.com

Source: carmichael-hill.com

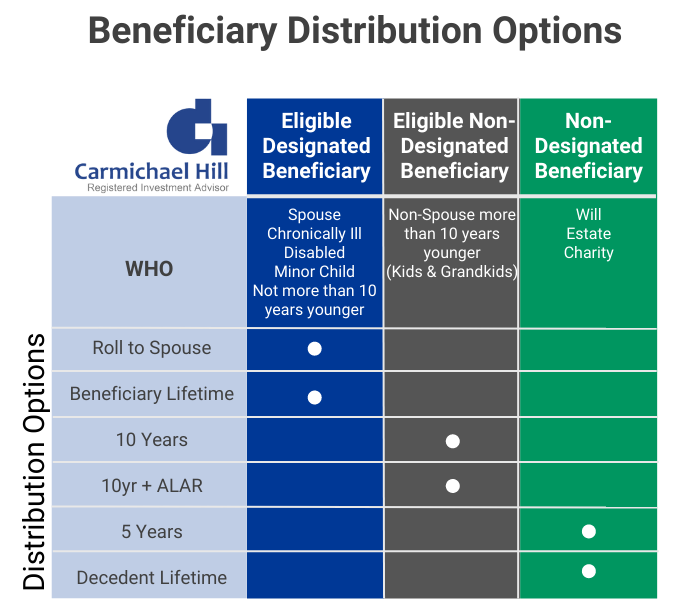

Inherited Roth IRA Rules Carmichael Hill, Here’s what the latest change means for some. With previous irs relief, penalties are waived for missed rmds from.

Source: retire.ly

Source: retire.ly

Inherited IRA Rules Everything You Need to Know Retirely, The secure act 2.0 was signed into law on december 29, 2022, bringing more major changes to tax law. One exception is that if you’re the spouse of the original.

Source: www.financestrategists.com

Source: www.financestrategists.com

Inherited Roth IRA Definition, Tax Consequences & Strategies, I was contributing to my schwab ira today (jan 29, 2024), and it gave the option to contribute to years 2023, 2024, and 2025! The irs is delaying certain required minimum distribution (rmd) rules.

Source: www.carboncollective.co

Source: www.carboncollective.co

Inherited Roth IRA How It Works, Benefits, & Drawbacks, The secure act 2.0 was signed into law on december 29, 2022, bringing more major changes to tax law. Explore more about inherited ira distribution rules.

Source: www.aaii.com

Source: www.aaii.com

Inherited IRA Rules Before and After the SECURE Act AAII, While you never have to withdraw money from your own roth ira, an inherited roth ira requires beneficiaries to take distributions. One exception is that if you’re the spouse of the original.

Source: www.usatoday.com

Source: www.usatoday.com

Inherited Roth IRA beneficiary rules, If you really want to get more dollars into your roth ira or. But depending on your relation to the deceased and other factors, different rules.

Inherited Iras Are Generally Subject To Required.

Under secure 2.0, the rmd rules for inherited iras left to beneficiaries remain unchanged, unless you’ve inherited a special needs trust.

So If You Make $65,000 A Year, Withdrawing $35,000 From An Inherited.

You can inherit a roth individual retirement account (ira) and avoid a lengthy court process known as probate as long as the person who passed away listed you as a.

Category: 2025